Abstract: After more than twenty years, there has been no economic crisis as severe as 1998 based on inflation and interest rates. It is interesting to compare the conditions before and after the 1998 crisis and the economic conditions in the last decade in Indonesia. Therefore, this study aims to analyze the relationship between inflation and interest rates using a copula-based joint distribution. The joint return period of the 1998 economic crisis is estimated from this joint distribution. The results showed that the Gumbel copula is the most suitable bivariate copula to construct a joint distribution between inflation and interest rates in 1990-2019, with an upper tail dependence of 0.6224. Moreover, the joint return period between inflation and interest rates more severe than 1998is 389 years with a 95% confidence interval of [47,∞] years. This result is uncertain because many factors affect inflation and interest rates. The inflation rate decreased after the 1998 crisis. Meanwhile, in the last decade, the inflation and interest rates were much lower than in the two previous periods.

Keywords: Copula; Economic crisis; Inflation rate; Interest rate; Joint Return Period; Uncertainty

link: https://doi.org/10.15642/mantik.2022.8.1.pp.10-17

Dipublikasikan pada J. Mat. Mantik, vol. 8(1), pp. 10-17.

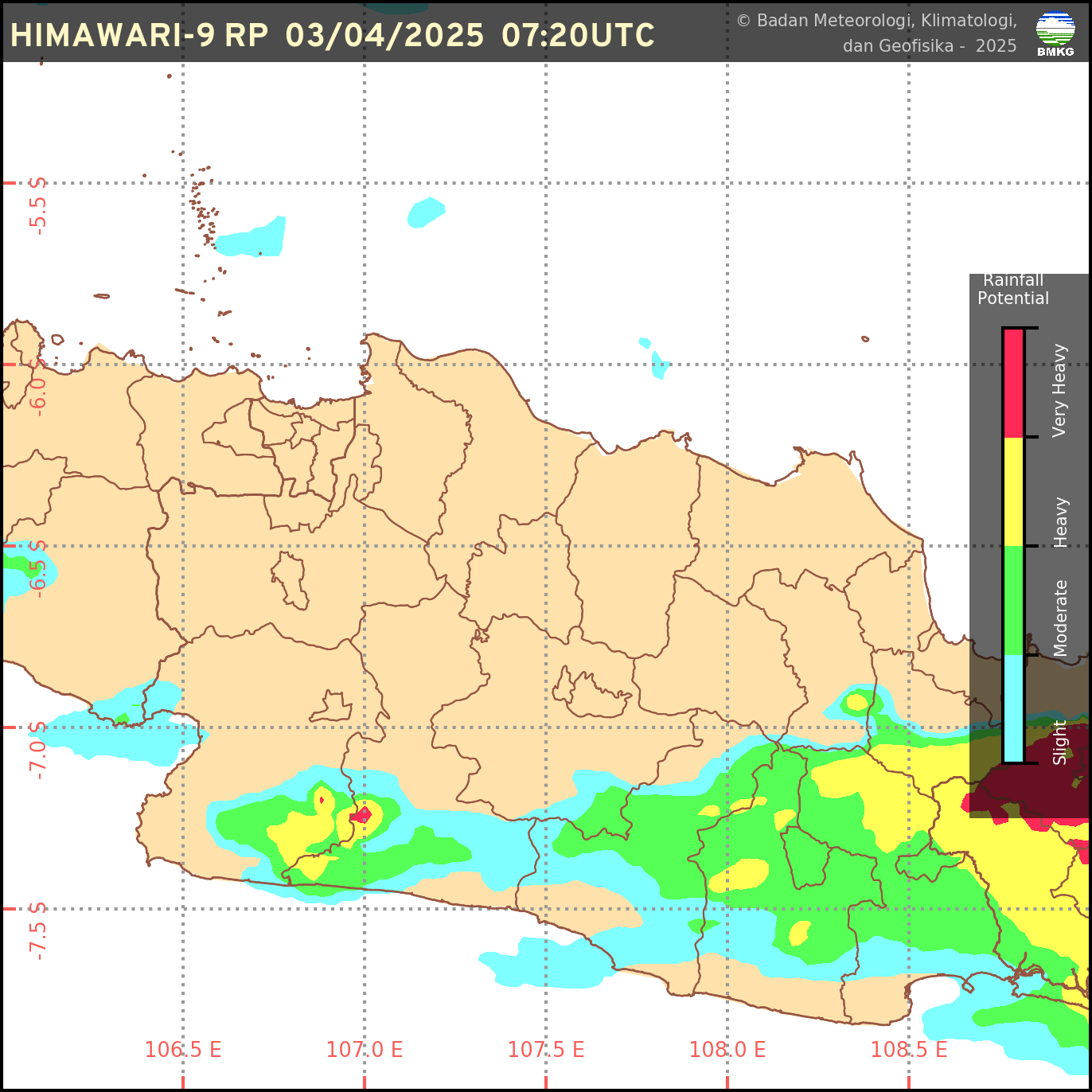

Sumber: BMKG

Sumber: BMKG

0 Komentar